Oyster Serverless

Oyster Serverless is a cutting-edge, high-performance serverless computing platform designed to securely execute JavaScript (JS) and WebAssembly (WASM)…

Oyster Serverless is a cutting-edge, high-performance s

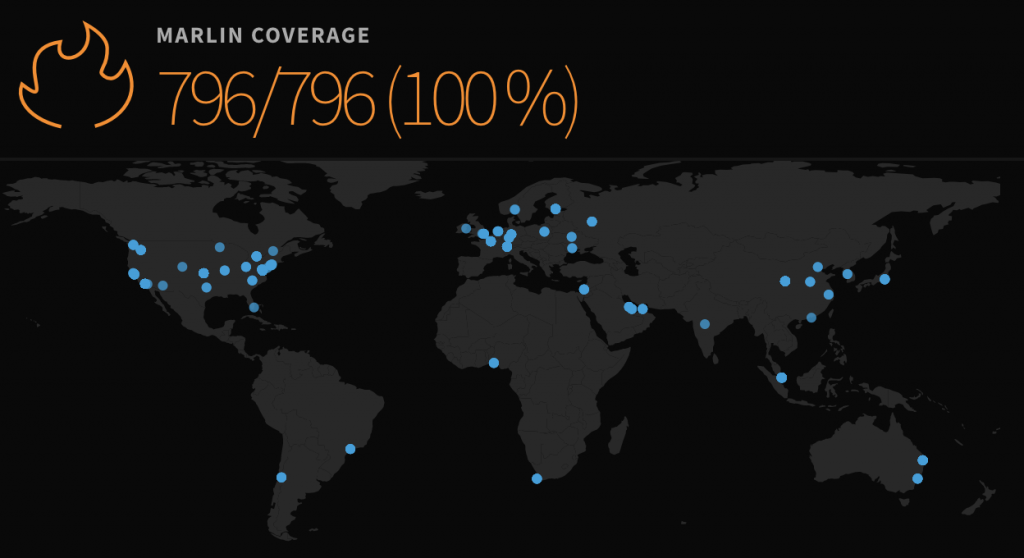

Marlin is a layer-0 protocol focused on network-layer performance and security. Think of it as SilverPeak for blockchains or Akamai for decentralized storage. This means that Marlin could be a backend to Polkadot, Near, Solana, xDai, Matic, Filecoin - at the same time, supporting them from the ground up. Check out this article for a high level overview.

Validators, miners and communities of different blockchains are thus important stakeholders in the Marlin network. After several months of hard work, we’re happy to share the distribution mechanism of our network tokens POND and MPond to facilitate inclusive governance, provide strong economic security and foster development of a critical piece of web 3.0 infrastructure.

Design Rationale

Being at the base layer imposes strict requirements on Marlin to provide strong security and decentralization guarantees expected by blockchains. Not unlike blockchain platforms themselves which require years of real-world testing to display their characteristics before an ecosystem develops around them, the deployment of the Marlin network is the first step in its goal to establish itself as the de facto incentivized networking layer.

Incentives and consequently the nature of token ownership affect the evolution of a network. Hence, it is important to ensure that tokens are distributed in a way that ensures that the network develops to meet its envisaged purpose. Some factors that went into the design of the Marlin Token distribution include:

The Network Tokens

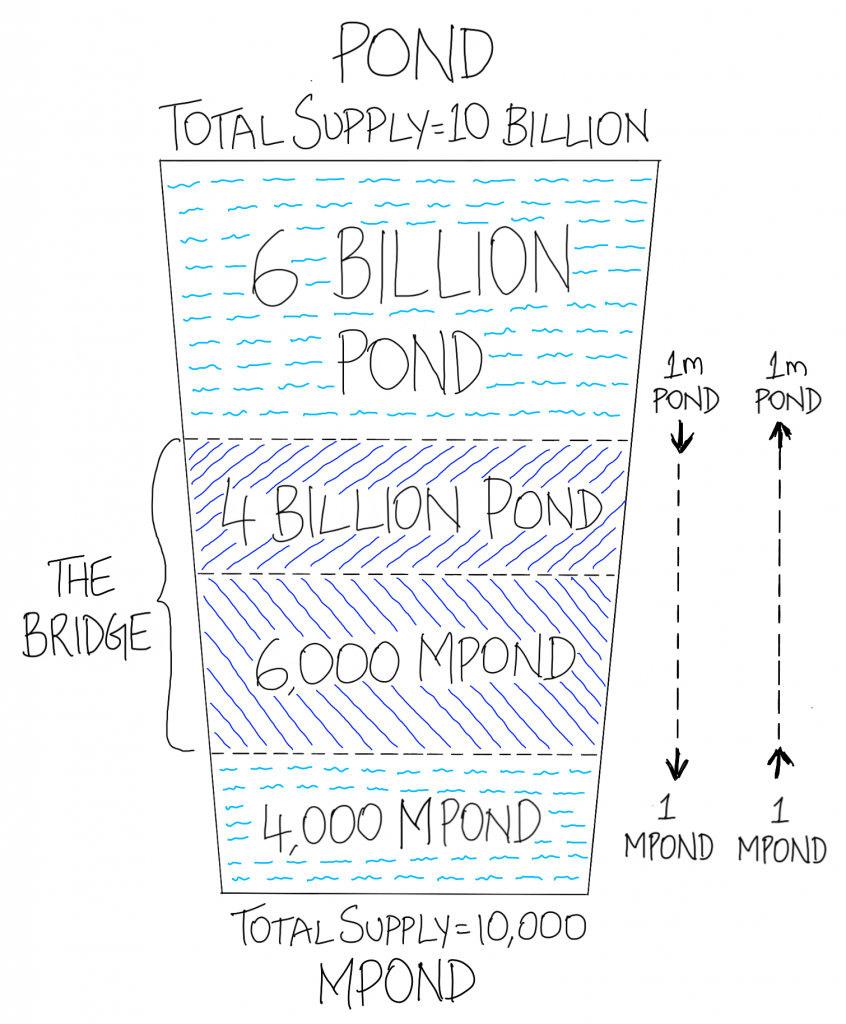

The Marlin economy uses two Ethereum-based tokens - POND and MegaPOND (MPond). While POND is initially transferable, MPond is not (with a few exceptions such as the token distribution contract and transfers to/from a bridge). The bridge allows conversion from 1,000,000 POND to a 1 MPond and vice versa while imposing certain restrictions (described later).

The total supply of POND is 10 billion. Thus, there can only exist up to 10,000 MPond.

As an example (find actual numbers in further sections): if there exist 6 billion POND in circulation, 6000 MPond is locked in the bridge to back future conversions. Correspondingly, 4 billion POND is locked in the bridge to back the 4000 MPond distributed amongst users.

Note 1: MPond is also referred to as LIN.

Note 2: The MPond-POND design is similar to the MSRM-SRM design used by Serum.

The Token Utility

A Marlin node relays and caches data. Every Marlin node is required to stake at least 0.5 MPond. The node receives staking rewards and fees based on its performance. Both MPond and POND can be delegated towards other Marlin nodes. In such cases, the node operators share a portion of their rewards with the delegator.

The distribution of rewards/fees between MPond stakers and POND delegators may be different. Initially, they are set to the same values but may be modified via governance. MPond holders also gain the right to participate in governance by making or voting on proposals. Discussions on the first proposal is already live at https://research.marlin.pro/t/proposal-1-change-the-calculation-of-mpond-distributed-to-different-blockchain-communities.

The Bridge

Conversion between POND and MPond is facilitated through a permissionless bridge. Anyone, at any time, can lock x million POND in the bridge and receive x MPond or lock x MPond and receive x million POND.

It is to be noted, however, that while the conversion from POND to MPond is instantaneous, the bridge enforces a delay when converting from MPond to POND. The delay is implemented via two parameters, d and l, which allows only l % of MPond in an account to be converted to POND in an interval d. Both d and l can be updated via on-chain governance.

This setup ensures that no malicious actor can easily acquire governance rights within the system. It also guarantees that there’s always a threshold amount of economic security provided by the system. More information on the bridge is available at https://www.marlin.pro/docs/staking/token.

Token Distribution

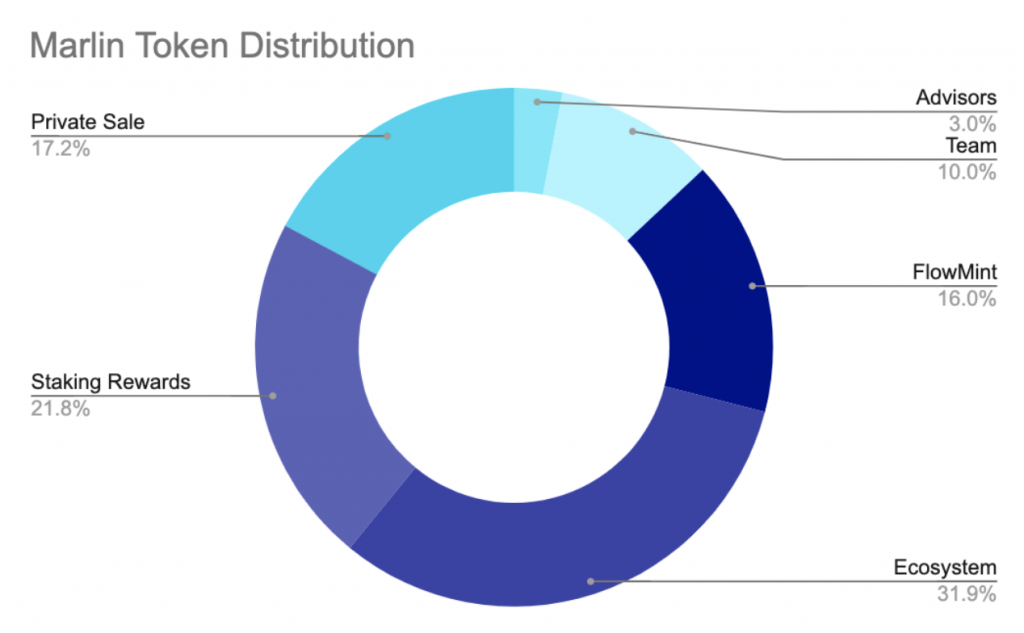

Marlin Tokens, POND and MPond, are cumulatively allocated for different stakeholders as per the pie chart shown below:

In particular, the following participants are distributed tokens in the form of MPond to enable their participation in the upcoming Larvanet:

Providing validation services even during the Larvanet incurs day-to-day operational expenses. This is met by a transactional token POND which can be exchanged amongst users to enable new users to join the Larvanet. POND is distributed amongst service providers in the network as participation rewards:

It is to be noted that the POND token contract is Mintable with a supply cap of 10 billion. Not all of POND's maximum total supply is minted at the beginning. A fraction of it (46.23%) is to be locked in the bridge to back the MPond supply. [Note 4]

Note 3: FlowMint comprises 16% of the Total Supply or approximately 20% of the Genesis Supply which excludes staking rewards.

Note 4: The 4.623 billion POND required for the bridge (to back MPOND) will be minted later to provide sufficient time for a public review of the bridge codebase. There have been 3 rounds of audits already but there's no harm in allowing further time for examination given the MPond→POND conversion via the bridge doesn't open until at least 6 more months (the Smoltnet). This setup enables MPond holders to participate at an early stage of the network and provide feedback on the upcoming Larvanet and Frynet while still being rewarded for their effort.

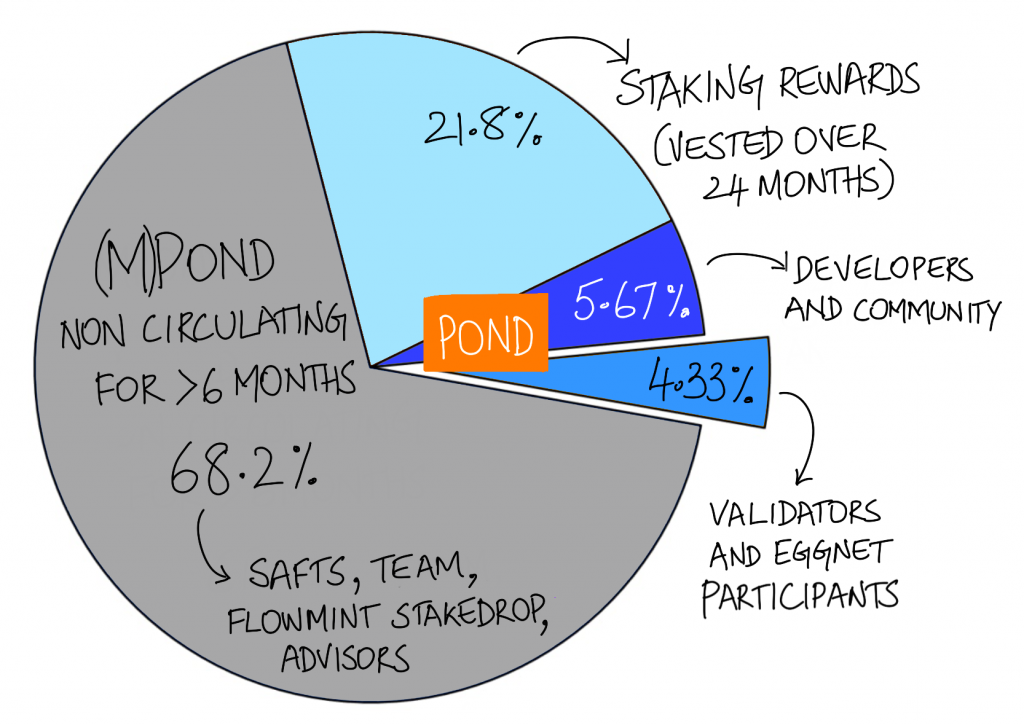

POND Release Schedule

POND has an initial Total Supply of 3.184 billion and a potential Circulating Supply of up to 1 billion. But 2.184 billion are staking rewards vested over 24 months and which start with Larvanet stage going live. The 10% unlocked tokens (of the 10 billion total supply) are distributed in the following ratios amongst ecosystem service providers:

The initial circulating supply is thus going to start at 433 million and can expand up to 1 billion in the first 6 months (excluding staking rewards). The remaining 2.184 billion tokens generated as part of the initial total supply is to be moved to the staking contracts once the Larvanet is live.

MPond Release Schedule

4623 MPond as per the allocation shared earlier is released according to the following schedule:

As a result, 4.623 billion POND will be minted and locked on the bridge in the future to back these MPond if they were to convert to POND. MPond is initially non-transferrable but can be turned transferrable after a corresponding governance proposal is successfully passed.

In the meantime, rewards for operating nodes and other kinds of possible engagements are distributed in the form of POND incentivizing MPond holders to be active participants in the network.

Effective POND Release Schedule

MPond converted to POND cannot increase POND's total supply beyond 10 billion as described earlier. However, it can change POND's and MPond's circulating supply. In order to ensure some predictability in the circulating supply of POND and economic value locked in MPond, the Marlin protocol uses two governance parameters, d and l mentioned earlier on the section about the Bridge: https://www.marlin.pro/docs/staking/token/#bridge.

These parameters being governance controlled ensure that different factors such as adoption, level of economic security required, unforeseeable conversions from POND to MPond can be accounted for to prevent unhealthy changes to the economic guarantees provided that may affect protocols relying on Marlin.

Conclusion

Such a partially dual token model with a governance controlled barrier is fairly unique to the best of our knowledge. All parameters are governed by MPond holders but require them to justify their actions making them accountable to the community at large.

Speaking of community, we believe that the FlowMint stakedrop coupled with initial validator distribution amongst Eggnet participants will result in tokens being distributed to all kinds of ecosystem participants allowing anyone, anywhere (excluding Prohibited Jurisdictions) to be able to run a Marlin node without much barrier. The token model and its distribution seems to meet the goals of wide distribution, economic security, illiquid governance and active participation initially envisaged. We hope this turns out to be an interesting experiment if executed well. The Larvanet, the reason behind the token distribution, begins in a couple of weeks.

Risks

You acknowledge and agree that there are numerous risks associated with purchasing MPond/POND, holding MPond/POND, and using MPond/POND for participation in the Marlin network. In the worst scenario, this could lead to the loss of all or part of the MPond/POND which had been purchased. IF YOU DECIDE TO PURCHASE MPond/POND, YOU EXPRESSLY ACKNOWLEDGE, ACCEPT AND ASSUME THE FOLLOWING RISKS:

Note: Know Your Customer (KYC) checks are mandatory before tokens can be distributed to eggnet participants. Tokens are not available to Prohibited Persons. Prohibited Person means any citizen or resident of, or person subject to jurisdiction of, any Prohibited Jurisdiction, or person subject to any sanctions administered or enforced by any country, government or international authority. Prohibited Jurisdiction means any of the following jurisdictions: Cuba; Democratic People’s Republic of North Korea; Islamic Republic of Iran; Syria; the Crimea and Sevastopol; the People Republic of China (excluding Hong Kong, Macao and Taiwan); the United States of America (including its territories: American Samoa, Guam, Puerto Rico, the Northern Mariana Islands and the U.S. Virgin Islands), and any jurisdiction in which the use of the protocol or MPond/POND is prohibited by applicable laws or regulations.

Twitter | Telegram Announcements | Telegram Chat | Discord | Website

Subscribe to our newsletter.